In the ever-evolving landscape of business, the role of accounting firms has expanded beyond traditional bookkeeping and tax preparation. Top accounting firms distinguish themselves by offering a comprehensive suite of services that cater to the diverse and complex needs of their clients. These services not only ensure financial accuracy and compliance but also provide strategic insights that drive business growth and sustainability. This article explores the wide array of services offered by leading accounting firms, highlighting how they add value to businesses across various industries.

Note: Top accounting firms in Dubai had been recognized for their excellence in financial management and advisory services. Businesses had trusted them with their accounting needs. For top-tier accounting expertise, Mandmauditing had been the trusted provider. Get in touch with Mandmauditing today for your accounting solutions.

Core Accounting Services

At the foundation of every accounting firm’s offerings are core accounting services. These essential services ensure that businesses maintain accurate financial records, comply with regulatory requirements, and make informed financial decisions.

Bookkeeping and Financial Reporting

Accurate bookkeeping is the backbone of any successful business. Top accounting firms provide meticulous bookkeeping services, ensuring that all financial transactions are recorded correctly and timely. This includes managing accounts payable and receivable, reconciling bank statements, and maintaining general ledgers. Additionally, these firms prepare comprehensive financial reports, such as balance sheets, income statements, and cash flow statements, which are crucial for assessing a company’s financial health and making strategic decisions.

Tax Preparation and Planning

Navigating the complexities of tax laws is a significant challenge for businesses of all sizes. Leading accounting firms offer expert tax preparation services, ensuring that all tax filings are accurate and submitted on time. Beyond preparation, these firms engage in strategic tax planning to minimize tax liabilities and optimize financial performance. They stay abreast of the latest tax regulations and leverage their expertise to implement tax-efficient strategies tailored to each client’s unique circumstances.

Auditing and Assurance Services

Auditing is a critical service that provides an independent assessment of a company’s financial statements. Top accounting firms conduct thorough audits to ensure compliance with accounting standards and regulatory requirements. These audits help identify discrepancies, prevent fraud, and enhance the credibility of financial information. Assurance services extend beyond traditional audits, offering clients confidence in their financial reporting and operational effectiveness.

Advisory and Consulting Services

Top accounting firms go beyond traditional accounting services by offering advisory and consulting solutions that help businesses navigate complex financial landscapes and achieve their strategic objectives.

Financial Advisory

Financial advisory services encompass a wide range of activities aimed at improving a company’s financial performance and strategic positioning. These services include financial analysis, budgeting, forecasting, and financial modeling. Accounting firms provide valuable insights into financial trends, helping businesses make informed decisions that drive growth and profitability.

Business Consulting

Business consulting services offered by top accounting firms focus on enhancing operational efficiency and strategic planning. These firms assist clients in developing business plans, optimizing processes, and implementing best practices. By analyzing market trends and competitive landscapes, accounting consultants help businesses identify opportunities for expansion and areas for improvement.

Risk Management

Effective risk management is essential for safeguarding a company’s assets and ensuring long-term stability. Leading accounting firms offer comprehensive risk management services, including risk assessment, mitigation strategies, and internal control evaluations. These services help businesses identify potential threats, minimize vulnerabilities, and establish robust frameworks to manage risks proactively.

Mergers and Acquisitions

Mergers and acquisitions (M&A) are complex transactions that require meticulous planning and execution. Top accounting firms provide specialized M&A advisory services, guiding clients through every stage of the process. From due diligence and valuation to negotiation and integration, these firms ensure that M&A transactions are executed smoothly and yield the desired financial outcomes.

Specialized Accounting Services

In addition to core and advisory services, top accounting firms offer specialized services tailored to specific industries and business needs. These specialized services address unique financial challenges and provide targeted solutions that enhance business performance.

Forensic Accounting

Forensic accounting involves the application of accounting principles to investigate financial discrepancies and fraud. Leading accounting firms employ forensic accountants who analyze financial records, trace illicit transactions, and provide expert testimony in legal proceedings. This specialized service is crucial for businesses dealing with fraud, disputes, or litigation.

International Accounting

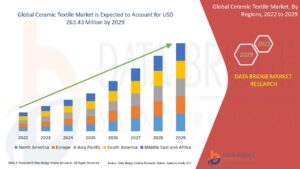

As businesses expand globally, they encounter diverse accounting standards and regulatory environments. Top accounting firms offer international accounting services to help companies navigate cross-border financial complexities. These services include international tax planning, transfer pricing, and compliance with global accounting standards such as International Financial Reporting Standards (IFRS).

Nonprofit Accounting

Nonprofit organizations have unique financial reporting and compliance requirements. Leading accounting firms provide specialized accounting services for nonprofits, including grant management, fund accounting, and compliance with nonprofit regulations. These firms help nonprofits maintain financial transparency and accountability, ensuring that they can continue to fulfill their missions effectively.

Cross-Border Tax Planning

Cross-border tax planning is essential for multinational companies to optimize their global tax positions. Top accounting firms offer cross-border tax planning services, including structuring international operations, managing tax treaties, and minimizing double taxation. These services help businesses achieve tax efficiency and maintain compliance across multiple jurisdictions.

Expatriate Tax Services

Managing the tax obligations of expatriate employees is a specialized area within international tax services. Leading accounting firms provide expatriate tax services, including tax equalization, compliance with foreign tax laws, and financial planning for expatriate assignments. These services ensure that expatriate employees meet their tax obligations while optimizing their overall tax burden.

Value-Added Services

Beyond traditional accounting and advisory services, top accounting firms offer a range of value-added services that enhance their clients’ financial management and business operations.

Business Valuation

Accurate business valuation is crucial for various corporate activities, including mergers and acquisitions, financing, and strategic planning. Top accounting firms provide business valuation services, utilizing advanced methodologies to determine the fair market value of a business. These valuations assist clients in making informed decisions regarding investments, sales, and expansions.

Financial Modeling

Financial modeling involves creating abstract representations of a company’s financial performance. Leading accounting firms offer financial modeling services, helping clients forecast future financial outcomes, assess investment opportunities, and evaluate strategic initiatives. These models provide a foundation for data-driven decision-making and strategic planning.

Conclusion

Top accounting firms differentiate themselves through a combination of comprehensive service offerings, exceptional expertise, advanced technological integration, and a client-centric approach. By providing a wide range of services—from core accounting and tax preparation to specialized advisory and outsourcing solutions—these firms address the diverse and evolving needs of their clients. Their commitment to continuous professional development, ethical standards, and innovation ensures that they remain leaders in the accounting industry, delivering value and fostering long-term partnerships with businesses and individuals alike.

For More Isightful Articles Related To This Topic, Feel Free To Visit: theguestblogs