As people’s financial needs continue to change and the demand for easy credit rises, Gold Loans have emerged as a dependable and well-liked choice. The most recurring question asked is, “What is a Gold Loan?” It is a secured loan in which borrowers give their gold coins or ornaments as security in order to obtain instant cash from banks or other financial institutions. Borrowers can obtain funds immediately by using these gold assets, doing away with the drawn-out application procedures and waiting periods connected to conventional loans. Gold Loans are a smart option in the current shifting economic climate since they offer a secure and convenient way to cover unforeseen expenses.

What is a Gold Loan?

To answer “What is a Gold Loan? “, it is a collateral loan where people mortgage their gold in order to raise money. It’s a simple process, with hardly any paperwork and quick approval. It’s a perfect solution for those needing funds, as the loan can be provided within no time. Unlike unsecured loans, which require one to possess a good credit record, Gold Loans offer a reasonable option for those who might not be eligible for bank services.

Gold Loans are in demand since they carry low interest and are simple to repay. The value of the loan will be based on gold valuation, and the weight and quality of gold will determine how much value one can get as the loan amount.

Why a Gold Loan Makes Sense in 2025

In today’s hectic life, a Gold Loan is convenient and accessible. Here’s how it’s becoming the choice for increasingly more individuals:

- Simple Access: Gold Loans are readily accessible throughout India, particularly in unbanked rural regions where customary loans might not be easily achieved.

- Quick Processing: Without much documentation, approval is quick. No waiting for weeks to get funds.

- Low-Interest Rates: The rates of interest are usually lower than those of personal loans, and hence, a favourable option for anyone who requires money urgently. This renders it an economical choice for different financial requirements.

- Easy Procedure: There is no requirement for proof of income or heavy documentation, thus making it very convenient for the common man to avail credit.

The Role of Gold Valuation in Gold Loans

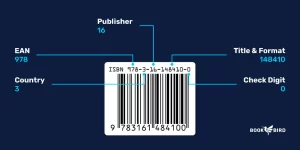

One of the primary determinants of the amount to be loaned is gold valuation. The purity and weight of the gold are evaluated by the lending institutions to calculate the amount of loan that can be taken. For example, a higher gold valuation guarantees the borrower access to a greater amount of the loan. It should be noted that, depending on its quality, the loan is given up to 75% of the market price of the gold.

It would be beneficial for any individual seeking to borrow against gold to understand how gold valuation is done. The purest gold will allow one to acquire a bigger loan. Gold Loans are an adaptive and reliable source of emergency capital.

Why Gold Loans Help Small Companies

Gold Loans are not exclusively meant for individual use; they can also be utilised to fund companies. Small enterprises and MSMEs can also avail of Gold Loans. It helps them increase working capital in a short time. Which can be utilised to meet cash flow requirements, buy inventory, or increase operations. Easy accessibility and low interest rates make Gold Loans a smart financial tool for businesses in 2025. They provide an easy way for entrepreneurs to raise the funds needed without the challenges associated with traditional loans. It comes with the benefit of quick disbursals*, a flexible repayment schedule, and minimal paperwork.

Gold Loan at Home: The Convenience Factor

The second aspect that increases the appeal of Gold Loans is the Gold Loan Home service. This provides customers with an opportunity to apply for and proceed with their Gold Loans from their homes. It’s a great choice for those who can’t easily access a branch or don’t want to spend a lot of time waiting. All you have to do is schedule an appointment, and a representative will send someone to assess your gold. Calculate the loan amount based on its valuation, and deposit the loan amount at your doorstep.

Why Choose a Gold Loan?

Gold Loans are a great financial option for anyone seeking instant and convenient funds. Whether it is for personal needs, business growth, or otherwise, they provide a convenient, safe, and flexible means of finance. Institutions offer loans to individuals seeking an easy means of obtaining financial assistance. These loans offer facilities such as attractive interest rates* and minimal documentation. For example, such facilities have been offered by organisations to millions of customers by means of easy disbursement of loans and repayment convenience.

Conclusion:

A Gold Loan is a smart financial decision for individuals and enterprises. For personal needs or business expansion, Gold Loans offer a convenient, quick, and cost-effective way of raising funds. With the added benefits of low interest rates*, easy repayment, and the comfort of taking loans based on gold valuation. It’s no wonder that Gold Loans are becoming a first-line financial choice. Gold Loans are an easy, safe, and reliable way for anyone looking for financial help without going through the trouble of long approval periods or lengthy documentation.

*Interest rates and loan amounts are subject to scheme eligibility.

*Terms and Conditions apply.