Introduction

Fleet management in Canada is undergoing a rapid transformation driven by technological innovation, regulatory changes, and evolving business needs. As companies seek to optimize vehicle usage, reduce operational costs, and improve safety, fleet management solutions are becoming integral to operations across industries such as transportation, logistics, construction, energy, and public services.

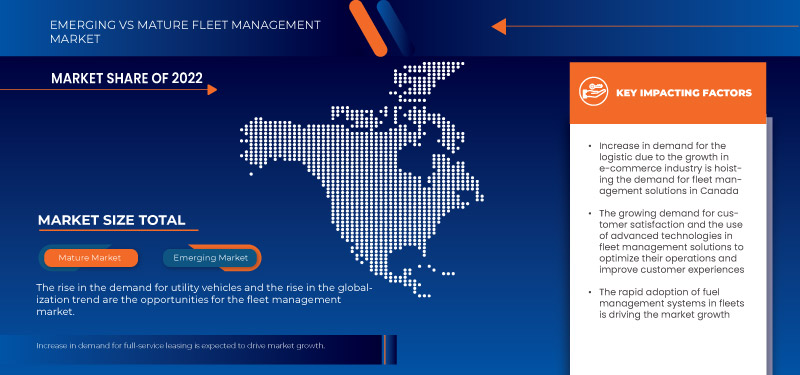

The Canadian fleet management market, valued at over CAD 2 billion in 2023, is expected to grow steadily with a compound annual growth rate (CAGR) of 8–10% through 2030. This growth is being fueled by increased adoption of telematics, electrification of vehicle fleets, and a strong push for operational efficiency and environmental compliance.

Market Overview

Fleet management involves a broad set of functions including vehicle tracking, maintenance scheduling, driver behavior monitoring, fuel management, route optimization, and compliance reporting. Traditionally managed through manual processes, the sector is now leveraging advanced telematics, GPS, and AI-powered platforms to automate and optimize fleet operations.

In Canada, the fleet management landscape includes both private and government sectors. Key adopters include transportation companies, delivery services, construction firms, oil and gas operators, and municipalities. With more than 1.5 million commercial vehicles on Canadian roads, the demand for effective fleet solutions is robust.

Key Market Drivers

-

Adoption of Telematics and IoT

The integration of telematics and Internet of Things (IoT) technologies is central to modern fleet management. These tools enable real-time monitoring of vehicle location, driver behavior, engine diagnostics, and maintenance needs. Canadian businesses are increasingly using telematics to improve decision-making and reduce operational risks. -

Regulatory Compliance

Fleet operators in Canada must comply with stringent regulations, including those related to emissions, electronic logging devices (ELDs), and driver safety. The Canadian ELD mandate, which became mandatory in 2023 for federally regulated carriers, has accelerated the adoption of digital fleet solutions. -

Cost Optimization

Rising fuel prices, maintenance costs, and insurance premiums are pushing fleet owners to seek smarter ways to manage expenses. Fleet management software helps reduce fuel consumption through route optimization and driver coaching, while predictive maintenance minimizes downtime and repair costs. -

Sustainability and EV Integration

Sustainability is becoming a business imperative, and fleet electrification is at the heart of many corporate ESG strategies. Government incentives and rebates for electric vehicles (EVs), along with growing availability of charging infrastructure, are encouraging the shift toward green fleets in Canada. -

Data-Driven Decision Making

Fleet management systems generate vast amounts of data that can be used for performance analytics, forecasting, and risk assessment. Canadian companies are leveraging this data to enhance productivity, enforce compliance, and strengthen customer service.

Challenges in the Market

While the market shows strong potential, it also faces some notable challenges:

-

High Initial Costs: Deploying advanced fleet management solutions can be capital intensive, particularly for small and mid-sized businesses.

-

Privacy Concerns: Monitoring driver behavior and vehicle locations raises concerns around employee privacy and data security.

-

Integration Issues: Integrating fleet management platforms with existing ERP and dispatch systems can be complex and time-consuming.

-

Geographic Diversity: Canada’s vast geography and harsh weather conditions in many regions pose unique logistical and maintenance challenges.

Key Segments

-

By Component

-

Solutions: Includes telematics, fleet tracking software, maintenance tools, fuel management, and route optimization.

-

Services: Encompasses consulting, installation, support, and maintenance.

-

-

By Vehicle Type

-

Light Commercial Vehicles (LCVs): Dominates the market due to high usage in urban delivery and field services.

-

Heavy Commercial Vehicles (HCVs): Includes long-haul trucks and industrial vehicles, particularly relevant in the energy and construction sectors.

-

-

By End-Use Industry

-

Transportation and Logistics

-

Construction

-

Oil and Gas

-

Retail and E-commerce

-

Government and Public Sector

-

Key Players in the Canadian Market

Canada’s fleet management market features a mix of global technology providers and regional specialists. Major players include:

-

Geotab: A Canadian telematics company headquartered in Ontario, known for scalable, data-driven fleet management solutions.

-

Verizon Connect: Offers comprehensive platforms for vehicle tracking, driver performance, and compliance.

-

Fleet Complete: Based in Toronto, this company provides solutions tailored for small to mid-sized fleets.

-

Trimble Inc.: Delivers fleet and asset management tools with strong analytics capabilities.

-

Samsara: Offers IoT-powered fleet solutions, with a growing presence in Canada.

These companies compete on pricing, customer service, software integration, and value-added features such as AI, predictive analytics, and mobile accessibility.

Trends to Watch

-

AI and Machine Learning

Artificial intelligence is being used to predict vehicle issues, assess driver behavior, and optimize route planning. Expect increased use of AI for automation and decision support. -

Mobile-First Platforms

Fleet managers and drivers rely on mobile apps for real-time updates, alerts, and task management. User-friendly mobile interfaces are becoming standard. -

EV Fleet Management

As more electric vehicles enter the fleet ecosystem, specialized software for monitoring battery health, charging schedules, and range optimization will gain prominence. -

Driver Safety and Training

Video telematics and real-time coaching are helping companies reduce accident rates and insurance claims, while improving driver retention and accountability. -

Integration with Smart City Infrastructure

As Canadian cities adopt smart transportation systems, fleet management will become increasingly connected with urban mobility solutions, including dynamic traffic routing and environmental monitoring.

Conclusion

Canada’s fleet management market is in a dynamic phase of innovation and growth. With increasing digital transformation across industries, businesses are recognizing the value of real-time data, automation, and sustainability in managing their fleets. While challenges around cost and integration remain, the long-term benefits of efficiency, safety, and environmental compliance are propelling widespread adoption.

As the country continues to push for cleaner transportation, smarter logistics, and safer roads, fleet management will remain a cornerstone of Canada’s commercial and public sector mobility strategy. Companies that embrace these technologies now will be better positioned to compete and thrive in an increasingly connected and regulated market.

Get more Details

https://www.databridgemarketresearch.com/reports/canada-fleet-management-market