If you’re looking for a way to build or improve your credit, MyMilestoneCard might be just the right tool for you. This credit card is specifically designed for individuals with limited or poor credit history, making it a great option for people who are new to credit or working to rebuild their credit score. But what exactly makes MyMilestoneCard stand out from other credit cards? In this post, we’ll explore the top five features of MyMilestoneCard that you should know about. Whether you’re just considering applying or you’re already a cardholder, these features will help you understand why MyMilestoneCard is a great option for your credit-building journey.

1. Easy Application and Approval Process

One of the first things you’ll notice about MyMilestoneCard is how easy it is to apply for and get approved. Traditional credit cards often require a good to excellent credit score for approval. However, MyMilestoneCard is designed specifically for people with less-than-perfect credit. Whether you’re new to credit or rebuilding after some setbacks, MyMilestoneCard offers a more accessible approval process.

You can apply for the card online in just a few simple steps. After completing the application, you’ll find out quickly whether you’ve been approved. The card offers a manageable starting credit line, so even if you’re just beginning to build your credit, MyMilestoneCard can be a great option.

2. Helps Build or Rebuild Your Credit Score

The main benefit of MyMilestoneCard is that it helps you build or rebuild your credit score. When you use a credit card responsibly, your payment history is reported to the major credit bureaus (Equifax, TransUnion, and Experian). MyMilestoneCard reports your activity every month, which means that your on-time payments can help improve your credit score over time.

To build a strong credit score, it’s important to make your payments on time and avoid carrying large balances. Using MyMilestoneCard responsibly by paying off your balance each month or keeping your balance low will show lenders that you are a reliable borrower, leading to a better credit score in the long run.

3. Access to Online Account Management Tools

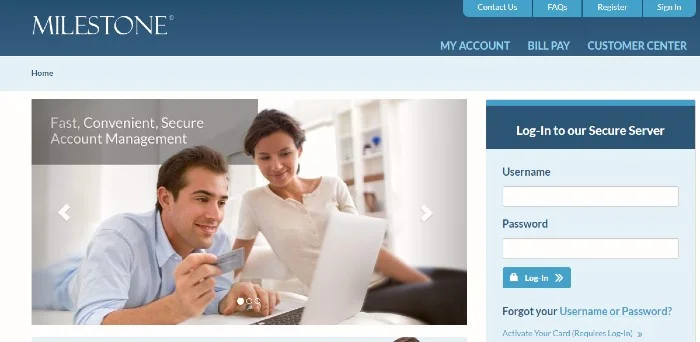

Managing your credit card account has never been easier with MyMilestoneCard. The card comes with user-friendly online tools that allow you to manage your account whenever you need to. You can log in to your account through the Milestone Bank credit card login portal. Once logged in, you can:

- View your balance and transactions

- Make payments

- Track your spending

- Set up account alerts

- Request credit limit increases (if applicable)

These tools make it simple to stay on top of your account and ensure you’re using your card responsibly. By logging into your account regularly, you can monitor your activity and avoid any surprises. Plus, setting up payment reminders can help you make sure your payments are always on time.

4. Reports to Major Credit Bureaus

MyMilestoneCard is an excellent choice for anyone looking to improve their credit score, as it reports your activity to the three major credit bureaus: Equifax, TransUnion, and Experian. Each of these bureaus tracks your credit activity, and your score is based on how responsibly you manage your credit.

What makes MyMilestoneCard particularly helpful for building credit is that every payment you make — whether it’s on time or late — is recorded and reported to these bureaus. By using the card responsibly, such as making timely payments and avoiding high credit utilization, you’ll be able to gradually improve your credit score. This is especially important for individuals who are trying to rebuild their credit or establish a positive credit history from scratch.

5. Security and Fraud Protection

Security is always a top concern when it comes to using credit cards. Fortunately, MyMilestoneCard comes with strong security features to protect you from fraud and unauthorized transactions. Some of the key security features include:

- Fraud protection: If your card is lost or stolen, MyMilestoneCard offers protection against unauthorized transactions, ensuring you’re not held responsible for fraudulent charges.

- 24/7 monitoring: Your account is constantly monitored for suspicious activity, giving you peace of mind that your financial information is safe.

- Online account locking: If you suspect that your card information has been compromised, you can lock your account instantly through the online portal.

With these security measures in place, you can feel confident using your MyMilestoneCard both online and in-person, knowing that your card details are protected.

Bonus Feature: Customer Service and Support

MyMilestoneCard offers dedicated customer service to help you with any questions or issues. Whether you need help with your account, have questions about your bill, or need assistance with technical problems like logging into your account, the customer support team is available to assist you.

Their customer service team is available through phone and online support, so help is always just a call or message away. Plus, you can access the Milestone Bank credit card login page anytime to make payments, view your transactions, and resolve any issues related to your account.

Conclusion

MyMilestoneCard is an excellent choice for anyone looking to build or rebuild their credit. With its accessible application process, ability to help improve your credit score, and easy-to-use online tools, this card offers a range of features that make managing your finances easier and more effective. Additionally, the reporting to major credit bureaus, security features, and helpful customer service ensure that you can use your card with confidence and peace of mind.

Whether you’re just starting your credit journey or working to improve your credit score, MyMilestoneCard is a reliable option that can help you achieve your financial goals. If you haven’t already, make sure to Milestone Bank credit card login and start managing your account today. Responsible use of MyMilestoneCard can set you on the right path to a better credit score and a stronger financial future.

Last Update: March 19, 2025