Blockchain technology has undergone a significant transformation since its inception with Bitcoin in 2009. Originally developed as the underlying infrastructure for cryptocurrencies, blockchain has now become a broad technological paradigm with applications across multiple industries. As of 2025, the blockchain market is characterized by diversification, rapid innovation, and increasing institutional adoption.

Growth Trajectory and Market Size

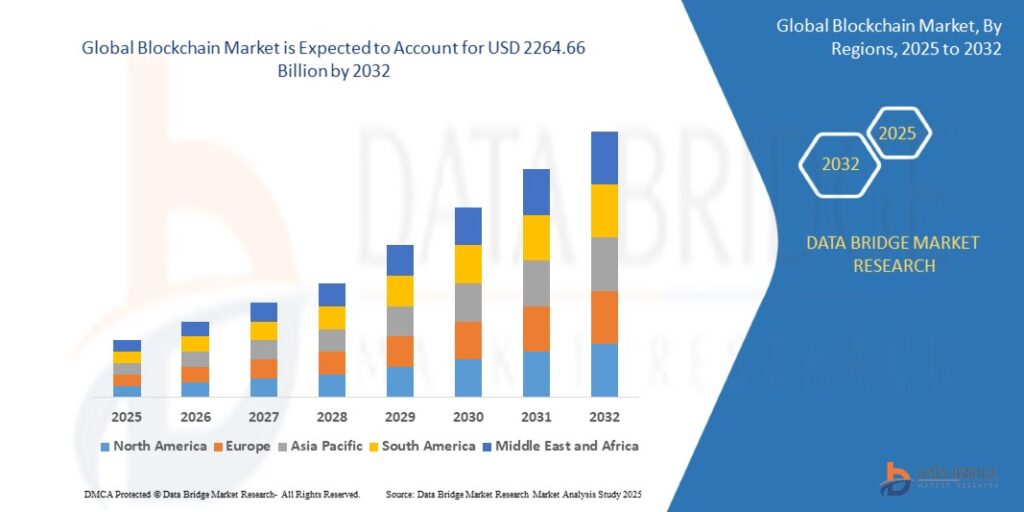

The global blockchain market has witnessed exponential growth over the past few years. According to recent industry reports, the market is expected to exceed $90 billion by 2030, growing at a compound annual growth rate (CAGR) of more than 50%. Key drivers include the expansion of decentralized finance (DeFi), increasing interest in non-fungible tokens (NFTs), and the adoption of blockchain for supply chain transparency, identity management, and smart contracts.

Notably, financial services remain the leading sector utilizing blockchain solutions. Banks and fintech companies are investing in blockchain to streamline payments, reduce fraud, and lower transaction costs. Central bank digital currencies (CBDCs) are also gaining traction, with countries like China, the European Union, and the U.S. exploring or piloting digital currencies backed by blockchain infrastructure.

Enterprise Adoption and Use Cases

Beyond the financial sector, enterprises are recognizing blockchain’s potential to improve efficiency, transparency, and trust. Prominent use cases include:

-

Supply Chain Management: Companies like IBM and Walmart use blockchain to track goods from origin to shelf, enhancing traceability and reducing fraud or waste.

-

Healthcare: Blockchain helps secure patient data, streamline insurance claims, and ensure the integrity of clinical trials.

-

Identity Verification: Blockchain-based digital IDs can provide secure, decentralized identity management, especially in regions with limited access to official documents.

-

Voting Systems: Governments and startups are piloting blockchain-based voting platforms to ensure election transparency and reduce tampering.

DeFi and the Reshaping of Finance

Decentralized finance (DeFi) is one of the most disruptive trends within the blockchain market. DeFi refers to a suite of financial services—such as lending, borrowing, and trading—built on public blockchains like Ethereum. These services operate without centralized intermediaries, relying instead on smart contracts.

The total value locked (TVL) in DeFi platforms has seen dramatic fluctuations, peaking at over $200 billion in 2021 before stabilizing in the tens of billions range in subsequent years due to market corrections and regulatory scrutiny. Nonetheless, DeFi continues to attract innovation and capital, with layer-2 scaling solutions and cross-chain interoperability becoming focal points for development.

NFTs and Digital Ownership

While NFTs have cooled from their 2021 hype cycle, the underlying concept of digital ownership remains powerful. NFTs are being applied beyond art and collectibles to areas like gaming, intellectual property, virtual real estate, and membership access. Projects like Yuga Labs’ Otherside and platforms like OpenSea are evolving their models to support more sustainable and utility-driven NFT ecosystems.

Major brands, including Nike, Adidas, and Starbucks, are incorporating NFTs into their customer engagement strategies, blending real-world loyalty with digital rewards.

Regulatory Landscape

Regulation is both a challenge and a catalyst for the blockchain market. Countries vary widely in their stance:

-

Supportive Jurisdictions: Nations like Switzerland, Singapore, and the United Arab Emirates are actively promoting blockchain innovation with clear regulatory frameworks.

-

Restrictive Environments: Countries such as China have banned cryptocurrency trading and mining but continue to explore blockchain for non-monetary uses.

In the United States and Europe, regulators are increasingly focused on consumer protection, anti-money laundering (AML) compliance, and systemic risk mitigation. The EU’s Markets in Crypto-Assets (MiCA) regulation and the U.S. SEC’s legal actions against certain crypto projects highlight the growing push for accountability and clarity.

Challenges and Limitations

Despite its potential, blockchain technology faces several hurdles:

-

Scalability: Most public blockchains still struggle to handle high transaction volumes with low latency and fees.

-

Energy Consumption: Proof-of-work (PoW) chains like Bitcoin are energy-intensive, although alternatives like proof-of-stake (PoS) and layer-2 solutions offer more sustainable models.

-

Interoperability: Seamless interaction between different blockchains remains limited, though progress is being made through projects like Polkadot, Cosmos, and Chainlink.

-

User Experience: Mass adoption is hindered by complex user interfaces, security concerns (e.g., private key management), and lack of education.

The Road Ahead: Trends to Watch

Looking forward, several trends are poised to shape the blockchain market:

-

Real-World Asset (RWA) Tokenization: Converting physical assets like real estate, stocks, or commodities into blockchain tokens is expected to unlock trillions in liquidity.

-

Blockchain-as-a-Service (BaaS): Tech giants such as Microsoft, Amazon, and Oracle are offering BaaS platforms to help businesses deploy blockchain applications with minimal infrastructure overhead.

-

Artificial Intelligence Integration: Blockchain can enhance AI transparency and accountability, while AI can optimize smart contract execution, fraud detection, and data analytics.

-

Decentralized Identity (DID): As data privacy becomes more important, DID solutions will empower individuals to control and share their personal data securely.

Conclusion

The blockchain market is transitioning from a niche innovation to a foundational layer for digital transformation. While still maturing, the technology is attracting unprecedented levels of investment, talent, and innovation. As scalability improves and regulation provides clarity, blockchain’s impact will likely extend far beyond cryptocurrencies—redefining industries and reshaping global digital infrastructure.

For businesses, governments, and individuals alike, understanding the evolving blockchain landscape is crucial to harnessing its opportunities while navigating its risks. The next decade promises not only technological breakthroughs but also societal shifts driven by decentralized systems of trust, value, and governance.

Get more Details

https://www.databridgemarketresearch.com/reports/global-blockchain-market