A Savings Account is a preferred choice for individuals looking to deposit their funds securely in a bank. These accounts not only offer safety but also allow account holders to earn interest on their deposits. Among the many benefits, the interest rate plays a crucial role in shaping how much your savings can grow over time. Explore this blog to understand the importance of Savings Account interest rates, how they are revised, and smart ways to maximise your earnings.

What Are Savings Accounts and Why Do Interest Rates Matter?

Opening a Savings Account with a trusted bank simply means that you have a bank account to park your funds and earn interest on it while keeping your money safe. Moreover, this type of account offers easy access to money anytime through ATMs, online banking, UPI, etc.

Account holders get a specific interest rate on the amount deposited, which is paid monthly or quarterly as per bank rules. While the rates are moderate compared to some investment products, Savings Accounts offer the advantages of security, convenience, and easy liquidity.

The interest you earn depends on the rate your bank offers and the average daily balance you maintain. Hence, any revision in interest rates can affect how much money you earn passively through your savings.

What Are the Latest Savings Account Interest Rates?

When you open a Savings Account, having the right knowledge about the Savings Account interest rates becomes equally important. As of 2025, leading banks like ICICI Bank offer tiered interest rates on Savings Accounts based on the end-of-day balance. Here’s how the rates are structured:

- Up to ₹ 50 lakh: 2.75% per annum

- Above ₹ 50 lakh: 3.25% per annum

These rates apply uniformly across regular Savings Accounts. Though the rates have been revised recently, they continue to offer safe and steady returns along with the added benefit of liquidity and easy access to funds through digital and branch banking.

How Is the Interest in a Savings Account Calculated?

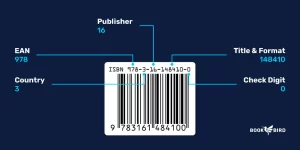

Most banks calculate interest on a daily closing balance, but credit the interest monthly or quarterly. Here’s the formula commonly used:

Interest = (Daily Closing Balance × Interest Rate × Number of Days) / 365

Example Calculation

If you maintain Rs. 1,00,000 daily in your Savings Account, and your bank offers 2.75% p.a. interest:

Interest = (1,00,000 × 2.75 × 30) / 365 = ₹226.03 (approx for one month)

Banks may offer tiered interest rates, meaning different parts of your balance may earn different rates. For example, the first ₹ 1 lakh may earn 2.75%, the next ₹ 49 lakh may earn 3.25%, and so on.

How Are Individuals Impacted By The Revised Interest Rates?

Here is how individuals are impacted by the revised interest rates from their respective banks:

- High-Balance Account Holders Benefit the Most

Individuals and businesses who maintain very high daily balances in their Savings Accounts are the highest gainers. For such individuals, even a small increase in interest rate can lead to significant income over time. This makes keeping money in Savings Accounts more rewarding than before.

- Mid-Level Depositors See Moderate Gains

People who maintain a moderate balance in their Savings Accounts may see some improvement in their returns if their bank has revised rates for their balance range. Though the gain might not be very large, it still makes a difference.

- Small Depositors Experience Little to No Change

For those who keep a low or average balance in their Savings Accounts, there may not be any change at all. Most banks continue to offer the standard interest rates for lower balances. So, if you use your Savings Account mainly for daily transactions and keep minimal funds, these revised rates might not impact your earnings.

Overall, whenever the bank changes the interest rate structure, it encourages people to be more mindful of how they use their savings account. It promotes better financial planning, whether by maintaining higher balances or exploring banks that offer better interest on smaller balances too.

Tips to Maximise Earnings From Your Savings Account

Here are some easy tips to maximise your earnings from your Savings Account:

- Compare Bank Interest Rates

It is important to know that you don’t have to settle for the first bank you come across for your Savings Account. Today, there are many reputed banks that offer attractive rates on Savings Accounts. Always compare and then choose the best one that suits your financial goals.

- Maintain Higher Daily Balance

Suppose you have your money sitting idle in the bank account, then maintaining a slightly higher average daily balance can help you move into a better interest bracket.

- Split Funds Strategically

You can also follow the strategy of distributing your funds across banks, selecting the ones that offer favourable returns for specific amounts.

- Opt for Sweep-In Accounts

Leading private sector banks like ICICI Bank offer auto sweep-in facilities that convert your idle balance into Fixed Deposits (FDs), giving you higher interest while maintaining liquidity.

Conclusion

Anytime a slight change takes place in your Savings Account interest rates, it opens up new possibilities, especially for those who keep higher balances in their accounts. Individuals and businesses that maintain substantial funds can now enjoy better returns simply by keeping their money parked smartly. By staying informed, choosing a bank that offers competitive interest rates, and maintaining a consistent balance, even small savers can improve their passive earnings.