North America Packaged Salad Market – Deep Dive Analysis & Forecast 2025–2033

Market Overview

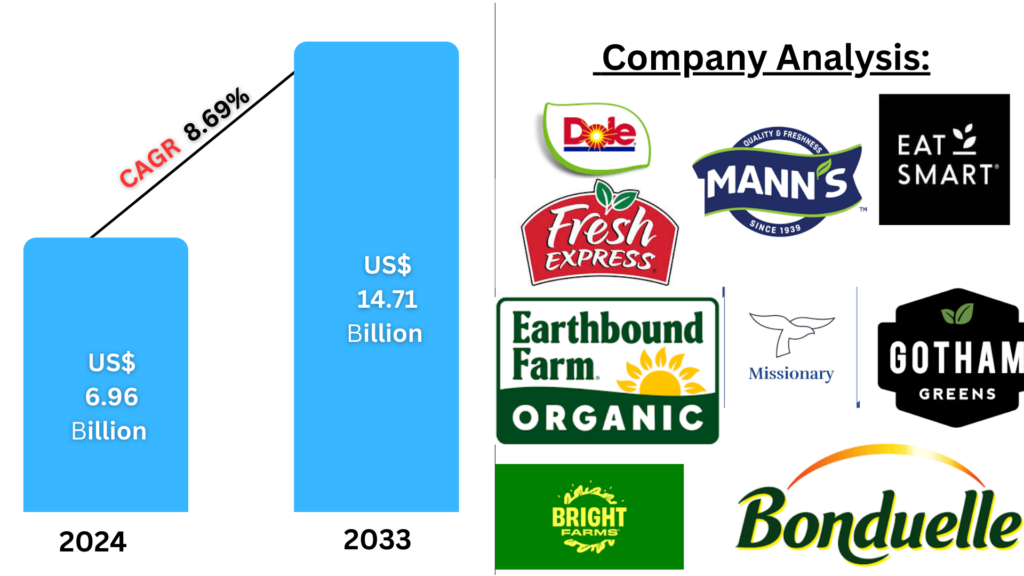

The North America packaged salad market is poised for robust expansion, with revenue projected to surge from US$ 6.96 billion in 2024 to US$ 14.71 billion by 2033, growing at a CAGR of 8.69%. This growth is fueled by rising health consciousness, demand for convenient meal solutions, and an increasing preference for organic and plant-based diets. Advancements in food processing and packaging technologies are further boosting consumer confidence and market scalability.

What Are Packaged Salads?

Packaged salads refer to pre-washed, ready-to-eat leafy greens and vegetables, often accompanied by toppings such as cheese, nuts, proteins, and dressings. Sold in sealed containers or bags, these products cater to busy consumers seeking nutritious and time-saving meal options.

Key Benefits:

- Convenience and time-efficiency

- Ideal for meal-prep and on-the-go lifestyles

- Available in both vegetarian and non-vegetarian formats

- Increasingly offered in organic and sustainable variants

Key Growth Drivers

- Rising Demand for Healthy, Ready-to-Eat Food

As urbanization increases and lifestyles become busier, consumers are shifting from traditional cooking to quick, health-conscious alternatives. Packaged salads align perfectly with this trend, offering high nutritional value without time-consuming preparation.

- Target Audience: Working professionals, fitness enthusiasts, meal-kit subscribers, and diet-focused consumers.

- Trend Insight: Growth in meal delivery platforms and e-commerce groceries has expanded access to fresh salads.

📌 Fresh Del Monte Produce, via Mann Packing, recently launched Newman’s Own™ Salad Kits targeting children’s health and nutritional balance.

- Shift Toward Organic & Plant-Based Diets

Consumers are becoming more environmentally and health-conscious, driving demand for organic and plant-based packaged salads. This aligns with sustainability trends and a collective move toward vegetarian and vegan diets.

- Product Expansion: Salad blends with organic greens, seeds, legumes, and superfoods.

- Consumer Motivation: Clean-label ingredients, pesticide-free produce, and transparent sourcing.

📌 Hippo Harvest has introduced USDA-certified organic salads available through Amazon Fresh and other retailers in California.

- Retail & E-commerce Growth

With the rapid proliferation of online grocery platforms and enhanced fresh produce sections in supermarkets, the market has become more accessible and diverse.

- Retail Giants: Walmart, Whole Foods, Kroger dominate fresh salad offerings.

- DTC Trends: Direct-to-consumer brands and subscription meal-kit services are fueling continuous demand.

📌 Fresh Del Monte’s launch of Newman’s Own™ Salad Kits emphasizes community giving while tapping into the premium salad kit segment.

Related Report

Market Challenges

- Limited Shelf Life and Perishability

The biggest operational challenge remains the short shelf life of fresh greens, which leads to spoilage, waste, and financial losses. Innovations such as Modified Atmosphere Packaging (MAP) and vacuum sealing are helping mitigate these issues.

- Intense Competition and Pricing Pressure

With multiple private-label and branded products competing, price sensitivity among consumers affects profitability. Brands must find a sweet spot between cost, quality, and brand differentiation to stay competitive.

Segment-Wise Analysis

- By Product: Vegetarian vs. Non-Vegetarian

- Vegetarian Packaged Salads: Feature leafy greens, grains, plant-based proteins, and ethnic flavors like Mediterranean and Asian. Popular among eco-conscious and wellness-oriented consumers.

- Non-Vegetarian Packaged Salads: Include protein-rich options like grilled chicken or shrimp. Preferred by consumers on high-protein, keto, or paleo diets.

📌 Fresh Express recently introduced Asian Apple and Twisted Caesar salad kits with restaurant-style taste profiles.

- By Processing: Organic vs. Conventional

- Organic Salads: Cater to rising demand for pesticide-free and sustainable farming practices.

- Conventional Salads: Still dominate in affordability and mass distribution, but are under pressure from clean-label trends.

📌 Retailers are pushing eco-friendly packaging and “farm-to-table” sourcing for organic offerings.

- By Type: Packaged Greens vs. Salad Kits

- Packaged Greens: Offer flexibility for consumers who wish to customize their salads at home. Popular greens include kale, romaine, spinach, and arugula.

- Packaged Kits: Come with dressings, toppings, and sometimes proteins. Ideal for quick meals and on-the-go lifestyles.

- By Brand: Branded vs. Private Label

- Branded Products: Dominated by Fresh Express, Taylor Farms, Dole, and Gotham Greens. Focus on premium quality and innovation.

- Private Labels: Offer affordability and have gained significant market share in recent years.

📌 Branded players are emphasizing clean-label branding, transparency, and sustainable sourcing.

- By Distribution Channel: Offline vs. Online

- Offline Sales: Supermarkets and specialty stores remain major sales channels. In-store promotions, freshness checks, and convenience influence buyer behavior.

- Online Sales: Rising quickly due to e-grocery platforms, subscription boxes, and meal delivery services.

Country-Wise Market Outlook

United States

The U.S. leads the market with advanced grocery retail infrastructure and high adoption of healthy eating habits. Innovation in packaging and increasing product diversity continue to attract consumers.

📌 Gotham Greens’ new salad kits are gaining popularity across Kroger and Jewel-Osco stores.

Canada

In Canada, packaged salads offer a reliable way to access fresh produce year-round. Consumers are increasingly interested in locally sourced and organic salad mixes.

📌 Fresh Express introduced new chopped kits tailored to Canadian taste preferences like Twisted Caesar Mexican Fiesta.

Mexico

Mexico’s packaged salad market is smaller but expanding steadily, driven by urbanization, improving retail infrastructure, and growing awareness of health and nutrition.

Competitive Landscape

The market is fragmented with key players focusing on innovation, regional expansion, and sustainability. All players are analyzed based on Company Overview, Key Personnel, Recent Developments, and Revenue Trends.

Major Players:

- BrightFarms

- Dole

- Earthbound Farm

- Eat Smart

- Missionero

- Gotham Greens

- Mann Packing Co., Inc

- BONDUELLE

- Fresh Express

Market Segmentation Summary

| Segment | Sub-Segments |

| Product | Vegetarian, Non-Vegetarian |

| Processing | Organic, Conventional |

| Type | Packaged Greens, Packaged Kits |

| Brand | Private Label Products, Branded Products |

| Distribution | Offline, Online |

| Countries | United States, Canada, Mexico |

Report Features

| Feature | Details |

| Base Year | 2024 |

| Forecast Period | 2025–2033 |

| Market Size Unit | US$ Billion |

| Delivery Format | PDF, Excel (PPT/Word on request) |

| Customization Scope | 20% Free |

| Post-Sale Analyst Support | 1 Year |

| Pricing | Starts at $2,490 |

Strategic Insights

- Companies must invest in cold chain logistics and shelf-life extension technologies.

- Diversification into ethnic and gourmet salad blends will attract a broader consumer base.

- Sustainability and clean-label certifications are no longer optional—they are critical to brand trust.

- Data-driven marketing and personalization (like diet-based targeting) can offer competitive advantages.

Final Thoughts

The North America Packaged Salad Market stands at the intersection of health, convenience, and sustainability. With growing consumer awareness, technological advancement, and product innovation, it presents significant opportunities for both legacy players and new entrants. Companies that focus on freshness, eco-conscious sourcing, and omnichannel retail strategies will thrive in this dynamic market.