Introduction

The global alcoholic beverage processing equipment market has experienced significant growth in recent years. This trend is driven by increasing demand for alcoholic beverages, advancements in brewing technologies, rising consumption in emerging markets, and evolving consumer preferences. From traditional brewing to high-tech distillation systems, equipment manufacturers are innovating rapidly to meet market needs.

This article explores the current landscape, key growth factors, technological advancements, and future outlook of the alcoholic beverage processing equipment industry.

Market Overview

The alcoholic beverage processing equipment market encompasses machinery used in the production of beer, wine, spirits, and other alcoholic drinks. This includes fermenters, distillation units, filtration systems, aging tanks, and packaging machinery.

As of 2024, the global market is estimated to be valued at approximately USD 22–25 billion, and it is projected to grow at a compound annual growth rate (CAGR) of 6% to 7% over the next five years. This growth is supported by both demand-side and supply-side trends.

Key Market Drivers

1. Increasing Alcohol Consumption Globally

Global consumption of alcoholic beverages continues to rise, particularly in developing economies such as India, China, and Southeast Asia. Urbanization, growing middle-class populations, and rising disposable incomes are key contributors to this trend.

2. Craft and Premiumization Movement

Consumers are increasingly interested in craft, artisanal, and premium alcoholic products. This movement has led to a surge in microbreweries, craft distilleries, and boutique wineries, which in turn has boosted the demand for small- to mid-scale processing equipment.

3. Technological Innovation

Modern equipment now features automation, IoT integration, and improved energy efficiency. These technologies help reduce labor costs, improve product consistency, and enhance traceability in production. Manufacturers are also introducing modular and scalable systems for greater flexibility.

4. Stringent Regulatory Standards

Rising health and safety standards across the food and beverage industry require producers to invest in high-quality, sanitary, and compliant equipment. This is especially critical in regulated markets like North America and Europe.

Equipment Types

The market includes a wide range of equipment types, categorized mainly by the beverage produced:

– Brewing Equipment

Includes mash tuns, lauter tuns, fermentation tanks, and kettles. Automation in beer brewing, especially in large-scale breweries, is a major area of investment.

– Wine Processing Equipment

Key machinery includes crushers, destemmers, fermenters, pressers, and oak aging barrels. Demand for high-end, stainless steel fermenters is increasing in premium wineries.

– Distillation Equipment

Used in the production of spirits such as whiskey, vodka, and gin. Technological improvements in continuous distillation and hybrid stills are attracting attention from craft distillers.

– Filtration and Bottling Systems

Both large and small producers rely heavily on high-quality filtration and bottling solutions to maintain shelf life, ensure safety, and meet packaging demands.

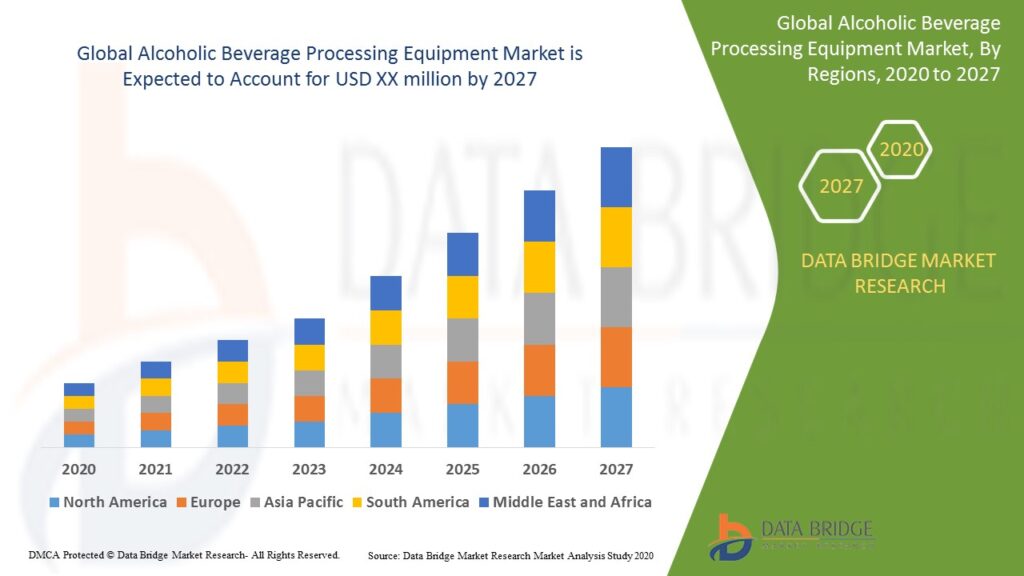

Regional Insights

– North America

The region remains a mature but stable market. The craft beer and spirits segments continue to grow, with over 9,000 breweries now operating in the U.S. alone. Equipment demand is high among microbreweries and craft distillers.

– Europe

Traditional strongholds like Germany, the UK, France, and Italy drive much of the demand. Sustainability and energy efficiency are top priorities for European producers, creating a push for green processing technologies.

– Asia-Pacific

This is the fastest-growing region due to rapid urbanization, rising disposable incomes, and shifting social attitudes toward alcohol consumption. China, India, and Japan are key markets, with increasing local production and foreign investments.

– Latin America and Middle East & Africa

These regions are experiencing steady growth, particularly in urban centers where international and local alcohol brands are gaining traction.

Competitive Landscape

The alcoholic beverage processing equipment market is moderately consolidated, with a mix of multinational corporations and specialized local vendors. Key players include:

-

GEA Group (Germany)

-

Alfa Laval (Sweden)

-

Krones AG (Germany)

-

Bühler Group (Switzerland)

-

Praj Industries (India)

These companies focus on innovation, energy efficiency, and customization to meet the diverse needs of producers around the globe. Smaller players often cater to niche segments such as craft distilling and organic wine production.

Emerging Trends

– Smart and Automated Systems

Automation, real-time monitoring, and smart sensors are now standard features in many new systems. These enable better control, traceability, and efficiency.

– Sustainable Processing Solutions

Eco-friendly designs, including closed-loop systems and water/energy-saving technologies, are increasingly in demand.

– Flexible and Modular Equipment

Producers want the flexibility to scale operations or switch between different types of beverages, especially in the craft segment. Modular designs are addressing this need.

– Contract Manufacturing and Cloud Integration

Some producers are outsourcing production or using cloud-based systems to manage equipment remotely. This trend is growing in line with the rise of “smart factories.”

Challenges

Despite growth, the market faces certain challenges:

-

High Initial Investment: Modern processing equipment requires significant capital, which can be a barrier for small producers.

-

Regulatory Compliance: Varying regulations across countries can complicate equipment design and installation.

-

Maintenance and Training: Complex automated systems need skilled operators and ongoing maintenance.

Future Outlook

The future of the alcoholic beverage processing equipment market looks promising, particularly as technology continues to improve and consumer demand remains robust. With sustainability, automation, and customization as key themes, equipment manufacturers who adapt quickly to changing trends will be well-positioned for growth.

Key future developments may include:

-

AI-driven quality control systems

-

Fully automated craft brewing solutions

-

Cloud-based predictive maintenance for distilleries

-

Integration of sustainable materials in equipment design

Conclusion

The alcoholic beverage processing equipment market is thriving, buoyed by global consumption trends, rising interest in craft and premium beverages, and technological innovation. As new markets open and consumer preferences evolve, the demand for efficient, flexible, and sustainable processing solutions is set to grow. Manufacturers who stay ahead of these trends will be crucial partners in shaping the future of the global alcoholic beverage industry.

Get more Details