Market Overview

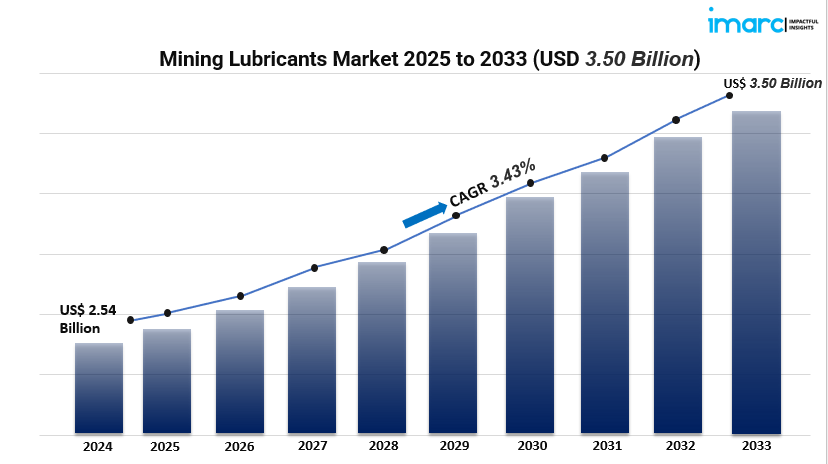

The global mining lubricants market is poised for steady growth, driven by the increasing demand for minerals and metals, expanding mining activities in emerging economies, and advancements in mining technologies. In 2024, the market reached a value of USD 2.54 billion and is projected to grow at a CAGR of 3.43%, reaching USD 3.50 billion by 2033. Key factors propelling this growth include stringent environmental regulations, the rise of automation, emphasis on cost optimization, and the surging demand for bio-based lubricants.

Study Assumption Years

- Base Year: 2024

- Historical Years: 2019–2024

- Forecast Years: 2025–2033

Mining Lubricants Market Key Takeaways

- Market Size & Growth: The market was valued at USD 2.54 billion in 2024 and is expected to reach USD 3.50 billion by 2033, growing at a CAGR of 3.43%.

- Regional Dominance: Asia Pacific leads the market, driven by countries like China and India, due to their extensive mining activities and demand for minerals.

- Product Segmentation: Mineral oil lubricants hold the largest market share, attributed to their affordability and widespread availability.

- Application Insights: Coal mining is the predominant application segment, reflecting the continued reliance on coal for energy production.

- Technological Advancements: The adoption of automation and predictive maintenance in mining operations is increasing the demand for high-performance lubricants.

- Environmental Considerations: Stringent environmental regulations are propelling the shift towards bio-based and synthetic lubricants.

- Market Drivers: Factors such as rising mechanization, infrastructure development, and the need for efficient mining operations are fueling market growth.

Market Growth Factors

- Technological Advancements in Mining Equipment

The mining industry is going through a quick tech change, with equipment getting smarter and more automatic. This progress means we need to use top-notch lubricants that can work in tough conditions, cut down on breakdowns, and make equipment last longer. As more mines start to use systems that predict when things need fixing and keep an eye on stuff from far away, there’s an even bigger need for special lubricants. These have to perform well all the time and help out with the fancy new machines.

- Stringent Environmental Regulations and Sustainability Goals

The world’s focus on protecting the environment has caused tough rules about emissions and waste control in mining. This change pushes companies to use bio-based and synthetic lubricants, which break down and are better for the environment. Companies are putting money into research to create green lubricants that follow environmental rules while still working well.

- Expansion of Mining Activities in Emerging Economies

Mining activities are on the rise in developing economies because of the growing need for minerals and metals crucial for building infrastructure and boosting industry. China India, and Brazil are putting a lot of money into mining projects, which means they’re using more mining lubricants. These countries are stepping up their mining operations thanks to government support, money from other countries, and the pressure to supply minerals to the world market.

Request for a sample copy of this report: https://www.imarcgroup.com/mining-lubricants-market/requestsample

Market Segmentation

By Product

- Mineral Oil Lubricants: These are cost-effective and widely used due to their availability and satisfactory performance in standard mining operations.

- Synthetic Lubricants: Known for superior performance, they are suitable for extreme conditions, offering better thermal stability and longer service life.

- Bio-Based Lubricants: Environmentally friendly options that are biodegradable, reducing ecological impact and complying with stringent environmental regulations.

By Equipment Function

- Engine: Lubricants designed to withstand high temperatures and pressures, ensuring engine efficiency and longevity.

- Hydraulic: Provide optimal performance in hydraulic systems, reducing wear and preventing system failures.

- Transmission: Ensure smooth power transmission and protect components from friction and wear.

- Gear: Specialized lubricants that reduce gear wear, noise, and enhance the lifespan of gear systems.

By Mining Techniques

- Surface Mining: Involves the extraction of minerals from the surface, requiring lubricants that can handle heavy machinery and dusty conditions.

- Underground Mining: Demands lubricants that perform well in confined spaces with high humidity and varying temperatures.

By Application

- Coal Mining: Dominant application segment due to the extensive use of coal in energy production.

- Bauxite Mining: Requires lubricants that can handle abrasive conditions and heavy equipment.

- Iron Ore Mining: Involves the use of lubricants that prevent equipment corrosion and wear.

- Precious Metals Mining: Demands high-performance lubricants for precision equipment.

- Rare Earth Mineral Mining: Utilizes specialized lubricants to handle unique extraction processes.

- Others: Includes various other mining activities requiring tailored lubrication solutions.

By Region

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

Regional Insights

The Asia Pacific region holds the top spot in the mining lubricants market, with China and India at the forefront due to their huge mineral deposits and widespread mining operations. The area’s quick move towards industry and building up infrastructure has an impact on the need for mining lubricants. On top of that helpful government rules and money put into mining projects play a part in making this market grow in the region.

Recent Developments & News

In 2024, FUCHS bought STRUB & Co. AG, which boosted its Swiss market presence and broadened its product range. That same year, ExxonMobil Corporation finished buying Pioneer Natural Resources Company to beef up its Permian Basin standing. Also, FUCHS Group inked a deal to purchase the LUBCON Group adding more variety to its specialty lubrication offerings. These smart moves show how the industry is zeroing in on growth new ideas, and reaching more places worldwide.

Key Players

- BP p.l.c.

- Chevron Corporation

- China Petroleum & Chemical Corporation

- ExxonMobil Corporation

- Fuchs Group Holding GmbH

- Klüber Lubrication (Freudenberg & Co. Kommanditgesellschaft)

- PetroChina Company Limited

- Quaker Chemical Corporation

- Royal Dutch Shell Plc

- Total SE

Ask Analyst for Customization: https://www.imarcgroup.com/request?type=report&id=5649&flag=C

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include a thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape, and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No: +1-631-791-1145