The London session forex time is one of the most significant trading periods in the forex market due to its high liquidity and volatility. Many traders capitalize on this session’s strong market movements to generate profits. At the same time, copy trading has gained popularity as a strategy that allows less experienced traders to follow and replicate the trades of professionals automatically. When properly optimized, copy trading can be highly effective during the London session forex time, helping traders benefit from major price swings and strategic entries.

Understanding the London Session Forex Time

The London session forex time officially begins at 08:00 GMT and ends at 17:00 GMT. However, the most active period is from 08:00 GMT to 12:00 GMT, when it overlaps with the latter part of the Asian session and the early hours of the New York session.

Key Characteristics of the London Session Forex Time

- High trading volume: London is the world’s largest forex trading hub, leading to high market participation.

- Strong price movements: Volatility increases as institutional traders, hedge funds, and banks execute large trades.

- Overlaps with other major sessions: The overlap with the New York session (12:00 GMT – 17:00 GMT) results in heightened trading activity.

- Major currency pairs dominate: GBP/USD, EUR/USD, and USD/JPY experience significant movement.

- Frequent breakouts: The session often sets the day’s trend, leading to breakout opportunities.

Understanding these dynamics is crucial for optimizing copy trading strategies during the London session forex time.

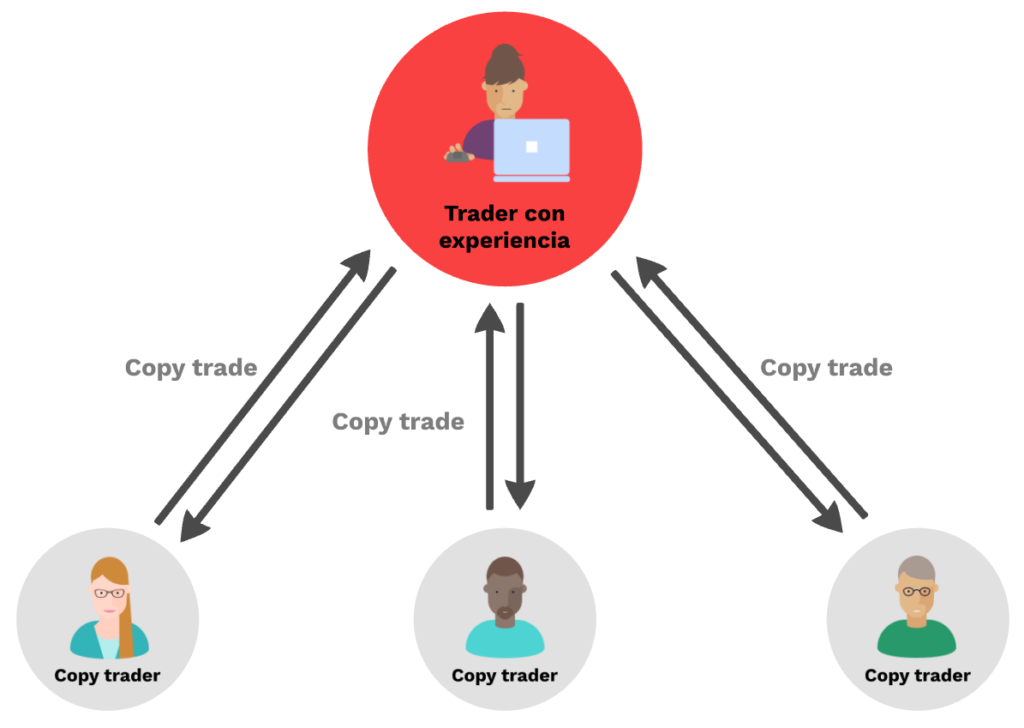

What is Copy Trading?

Copy trading is a trading method where traders replicate the trades of experienced professionals. This allows beginners or those with limited time to benefit from expert analysis and strategy execution without conducting their own market research.

Advantages of Copy Trading

- Time efficiency: No need for constant market analysis.

- Access to expert strategies: New traders can learn from professionals.

- Diversification: Traders can copy multiple strategies to reduce risk.

- Automated execution: Trades are copied in real-time without manual intervention.

Since the London session forex time is known for high volatility, copy traders must select appropriate strategies and professional traders who perform well in fast-moving markets.

Why the London Session Forex Time is Ideal for Copy Trading

1. Increased Market Liquidity

The London session forex time offers some of the highest liquidity in the market, making it easier to execute trades with minimal slippage. Copy traders benefit from:

- Tighter spreads

- Faster trade execution

- More predictable market movements

2. Favorable Conditions for Trend and Breakout Strategies

Many professional traders use breakout trading and trend-following strategies during the London session forex time due to strong price action. Copy traders can benefit by following experts who specialize in these methods.

3. Overlap with the New York Session

The London session forex time overlaps with the New York session for five hours (12:00 GMT – 17:00 GMT). This period sees some of the most significant price movements, making it ideal for copy traders looking to capture momentum-based trades.

4. High-Impact Economic News Releases

During the London session forex time, major economic reports from the UK, Eurozone, and the US are released. Copy traders can follow professionals who incorporate fundamental analysis into their trading decisions.

Optimizing Copy Trading Strategies in the London Session Forex Time

1. Choosing the Right Traders to Copy

To succeed in copy trading during the London session forex time, traders should select professionals with:

- A strong track record of profitability during high-volatility periods.

- Expertise in trading major currency pairs such as GBP/USD and EUR/USD.

- A well-defined risk management strategy.

2. Managing Risk in a Volatile Market

Since the London session forex time is highly volatile, copy traders must use risk management techniques such as:

- Setting stop-loss orders to prevent excessive losses.

- Using appropriate position sizing to avoid overexposure.

- Monitoring multiple traders to diversify risks.

3. Timing Trades Effectively

Different hours within the London session forex time provide unique opportunities:

- 08:00 GMT – 10:00 GMT: Highest volatility as the session opens.

- 12:00 GMT – 15:00 GMT: Increased liquidity due to the New York session overlap.

- 15:00 GMT – 17:00 GMT: Trend continuation or reversals before market close.

4. Adapting to Market Conditions

Market conditions change rapidly during the London session forex time. Copy traders should monitor:

- Breakout trends in the early hours.

- Pullbacks and corrections as the session progresses.

- News-driven volatility, especially during major announcements.

Challenges of Copy Trading During the London Session Forex Time

Despite the advantages, there are challenges associated with copy trading in this session:

- Sudden market reversals due to news releases.

- Not all traders perform well under high volatility.

- Slippage risk if not using a reliable broker.

Copy traders must continuously analyze the performance of the professionals they follow to ensure consistency in results.

Conclusion

The London session forex time is one of the best periods for copy trading, offering high liquidity, strong price movements, and strategic trading opportunities. By selecting the right traders to follow, managing risk effectively, and adapting to market conditions, copy traders can enhance their success in this session. While copy trading simplifies the forex trading process, understanding the unique characteristics of the London session forex time ensures long-term profitability and consistency.