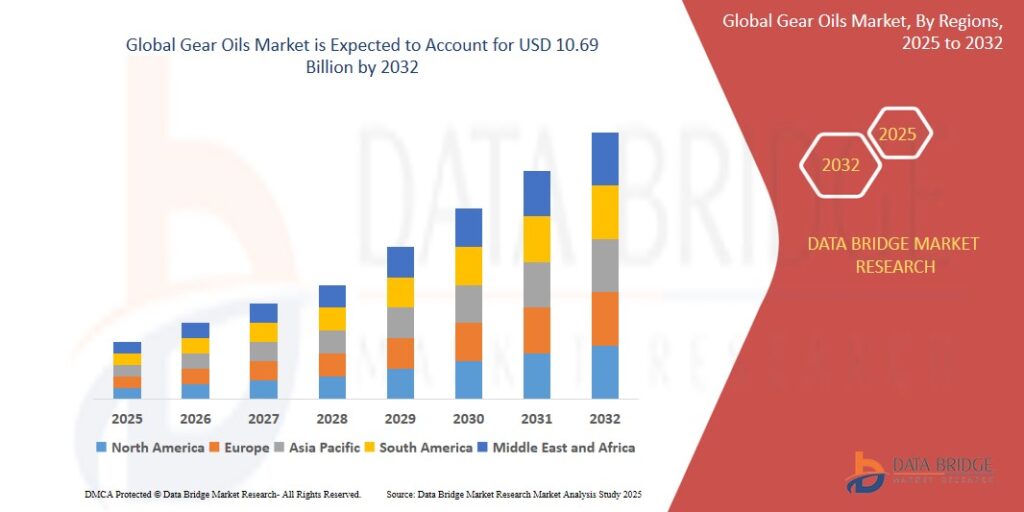

Global Gear Oils Market: Trends, Drivers, and Forecast Analysis

Content:

The global gear oils market has grown steadily in recent years, bolstered by expanding industrial activities, growth in the automotive and manufacturing sectors, and increasing demand for high-performance lubricants. Gear oils are essential for reducing friction and wear in gear systems. They help enhance operational efficiency, reduce maintenance costs, and prolong equipment life. Used across industries such as automotive, mining, construction, wind energy, and marine, gear oils are a key component of efficient machinery operation.

As industries focus more on reducing downtime and improving the efficiency of mechanical systems, the role of gear oils becomes even more prominent. In parallel, evolving environmental standards and performance requirements have led to a transition toward synthetic and bio-based gear oils, creating new dynamics in the market.

Market Overview

Gear oils are specially formulated lubricants designed to protect gearboxes, differentials, and other gear-based mechanical components. These oils help prevent surface fatigue, pitting, corrosion, and scuffing, even under high-pressure and temperature conditions. Gear oils come in several varieties, including mineral-based, synthetic-based, and bio-based formulations, with additive packages tailored to specific operating conditions and industry needs.

The gear oils market is typically segmented by base oil type, end-use industry, and geography. Increasingly stringent regulations around emissions and lubricant disposal are driving innovation in product formulation and lifecycle sustainability.

Key Market Drivers

1. Growth in Automotive Production and Aftermarket

The global automotive industry is a major consumer of gear oils, especially for transmission systems, axles, and differentials. As vehicle production increases, especially in emerging markets like India, Brazil, and Southeast Asia, the demand for automotive gear oils rises in tandem. The expanding vehicle parc (vehicles in operation) also fuels aftermarket sales, contributing to steady gear oil consumption.

2. Industrial and Manufacturing Expansion

Heavy machinery used in manufacturing, steel, cement, food processing, and chemical production depends heavily on gear systems. As global industrialization continues, especially in Asia-Pacific and the Middle East, the demand for industrial-grade gear oils is rising. Additionally, increasing automation in factories means more complex gear systems that require high-performance lubricants.

3. Renewable Energy Development

Wind energy, a fast-growing renewable source, uses gearboxes in turbines that require specialized gear oils with excellent thermal stability and long service intervals. As the global focus on sustainable energy expands, so does the need for advanced lubricants suited for harsh and remote conditions.

4. Rising Demand for Synthetic Oils

Synthetic gear oils, including polyalphaolefins (PAOs) and esters, offer superior performance in extreme temperatures and high-load conditions. Though costlier than mineral oils, they provide better oxidation resistance, longer service life, and energy efficiency. These qualities make them increasingly popular in sectors where uptime and reliability are critical.

Market Segmentation

By Base Oil Type:

-

Mineral Oil: Traditionally dominant due to lower cost and wide availability.

-

Synthetic Oil: Gaining ground for its superior properties and longer drain intervals.

-

Bio-Based Oil: Emerging segment, driven by environmental concerns and regulations.

By Application:

-

Automotive: Passenger cars, commercial vehicles, off-highway vehicles.

-

Industrial: Manufacturing equipment, mining, construction, and power generation.

-

Marine: Gear oils used in ships and offshore equipment.

-

Wind Energy: Specialized lubricants for turbine gearboxes.

By Region:

-

North America: A mature market with a shift toward synthetic lubricants.

-

Europe: Strict environmental regulations are pushing demand for bio-based oils.

-

Asia-Pacific: The fastest-growing region, led by industrialization and automotive growth.

-

Latin America and Middle East & Africa: Steady demand from mining and oil & gas sectors.

Competitive Landscape

The gear oils market is moderately consolidated, with key global players competing on the basis of product performance, innovation, and sustainability. Strategic partnerships with OEMs (Original Equipment Manufacturers), focus on R&D, and expanding regional footprints are common growth strategies.

Key Market Players Include:

-

Royal Dutch Shell Plc

-

ExxonMobil Corporation

-

Chevron Corporation

-

TotalEnergies SE

-

BP Plc (Castrol)

-

Fuchs Petrolub SE

-

Valvoline Inc.

-

Petro-Canada Lubricants Inc.

These companies offer extensive portfolios of gear oils tailored to different industries and conditions. With increasing competition and technological advancements, product differentiation has become crucial, particularly in the high-performance synthetic and environmentally friendly segments.

Industry Challenges

Despite promising growth prospects, the gear oils market faces certain challenges:

-

Environmental Regulations: Growing restrictions on the disposal and formulation of lubricants are pressuring manufacturers to shift toward biodegradable and low-toxicity options.

-

Price Volatility in Raw Materials: The cost of base oils and additives fluctuates with crude oil prices, impacting profit margins and pricing strategies.

-

Technological Shifts in Automotive: The rise of electric vehicles (EVs), which have fewer moving mechanical parts compared to internal combustion engine (ICE) vehicles, may eventually reduce demand for traditional gear oils in the automotive segment.

-

Counterfeit Products: Especially in developing markets, the proliferation of counterfeit and substandard gear oils poses risks to machinery and affects the credibility of reputable brands.

Emerging Trends and Opportunities

-

Bio-Based and Eco-Friendly Lubricants: Governments and corporations are increasingly investing in sustainable solutions. This trend opens up opportunities for gear oil manufacturers offering biodegradable and non-toxic formulations.

-

IoT and Predictive Maintenance: Advanced lubricants are now integrated with condition monitoring systems. Gear oils with embedded sensor technology or compatibility with IoT platforms can help track lubricant condition and prevent equipment failure.

-

Customized Formulations: As industries become more specialized, demand for application-specific gear oils is rising. This allows manufacturers to develop niche products for sectors like aerospace, food-grade processing, and high-speed manufacturing.

Future Outlook

The global gear oils market is projected to grow at a steady pace, with estimates suggesting a compound annual growth rate (CAGR) of 3.5% to 5.5% through 2030. The shift toward synthetic and bio-based lubricants, coupled with rising demand from emerging economies, will shape the market landscape. Players that invest in sustainable R&D, digital integration, and regional expansion are likely to outperform.

Conclusion

The gear oils market is a foundational component of global industrial and mechanical systems. As technology evolves and sustainability takes center stage, gear oils will continue to adapt, offering more efficiency, durability, and environmental compatibility. With rising demand from key sectors such as automotive, manufacturing, wind energy, and marine, the market offers significant growth opportunities for both established players and new entrants.

Get more Details

https://www.databridgemarketresearch.com/reports/global-gear-oils-market