Growth and Innovation in the Europe Oil Field Specialty Chemicals Market

The Europe oil field specialty chemicals market is experiencing a period of strategic transformation, driven by a mix of geopolitical dynamics, increasing environmental regulations, and technological innovations. These chemicals, critical to various upstream oil and gas operations, are now being tailored to meet modern demands for efficiency, sustainability, and performance. As exploration and production (E&P) activities adapt to the challenges of deeper wells and unconventional reserves, specialty chemicals are playing an increasingly central role in operational success.

Overview of Specialty Chemicals in Oil Fields

Oil field specialty chemicals are formulated products used in drilling, cementing, well stimulation, production, and enhanced oil recovery. Unlike basic industrial chemicals, they are engineered for specific functionalities and performance under extreme conditions, such as high pressures, temperatures, and corrosive environments.

Common categories include:

-

Demulsifiers

-

Corrosion inhibitors

-

Scale inhibitors

-

Biocides

-

Friction reducers

-

Surfactants

-

Polymers

These chemicals help enhance oil recovery, protect equipment, ensure flow efficiency, and maintain safety standards.

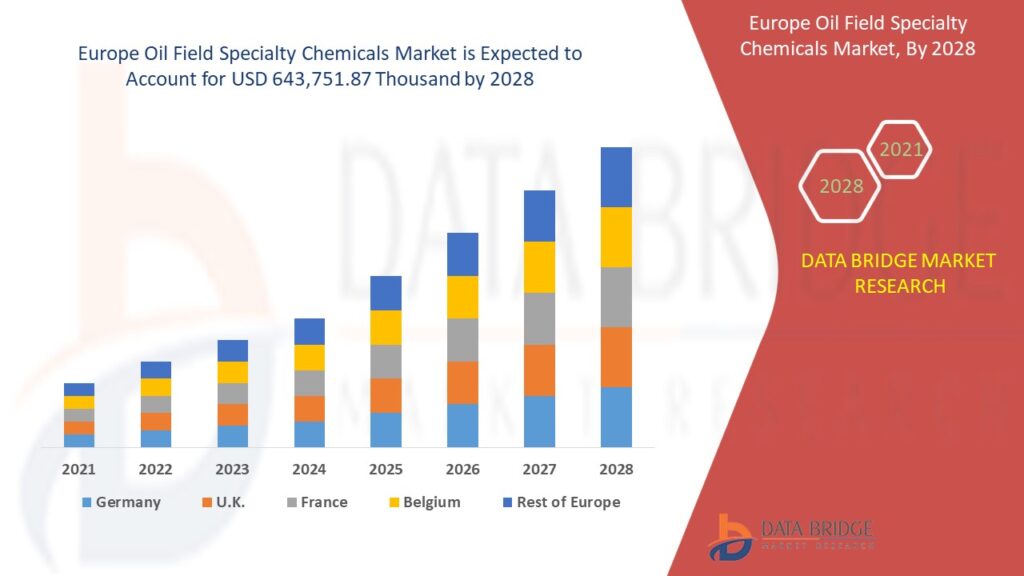

Market Size and Growth Prospects

As of 2024, the Europe oil field specialty chemicals market is estimated to be valued at around USD 2.5 billion, with a projected compound annual growth rate (CAGR) of 3.5% to 5% through 2030. This modest yet steady growth is supported by the region’s focus on revamping mature fields, improving operational efficiency, and meeting stringent environmental standards.

Key contributing countries include:

-

Norway and the UK: Major contributors due to offshore activities in the North Sea.

-

Germany and the Netherlands: Smaller but technologically advanced segments.

-

Russia (European part): A significant market for chemical demand due to vast reserves, though affected by sanctions and trade limitations.

Drivers of Market Growth

1. Offshore and Deepwater Exploration

Europe’s offshore basins, particularly the North Sea and the Barents Sea, continue to be active areas for exploration. These harsh environments require high-performance specialty chemicals that can withstand extreme conditions and reduce downtime.

2. Enhanced Oil Recovery (EOR) Demand

With many European oil fields reaching maturity, EOR techniques are increasingly being used. Chemical EOR methods—using surfactants, polymers, and alkaline agents—are in demand for their ability to maximize extraction from aging reservoirs.

3. Environmental Regulations and Sustainability

European environmental policies are among the strictest in the world. Regulatory pressure has led to the development and adoption of “green” or environmentally friendly oil field chemicals, particularly in offshore drilling.

4. Focus on Operational Efficiency

As oil companies seek to reduce operational costs while maintaining output, specialty chemicals are being optimized for better performance at lower dosages. Smart formulations and real-time chemical monitoring are part of this shift.

5. Integration of Digital Technologies

Smart chemical injection systems and real-time monitoring are enabling more precise chemical usage. Digitalization not only improves efficiency but also helps ensure compliance with environmental standards.

Market Challenges

Despite the positive outlook, several challenges could restrain the market:

-

Volatile Crude Prices: Price fluctuations can delay or cancel drilling projects, directly affecting chemical demand.

-

Geopolitical Instability: The Russia-Ukraine conflict and related sanctions have disrupted supply chains and impacted market dynamics.

-

High R&D and Compliance Costs: Developing environmentally safe and effective chemicals involves significant investment in R&D and testing.

-

Alternative Energy Shift: Europe’s push toward renewable energy is reducing long-term dependence on fossil fuels, which may gradually slow down oil and gas activity.

Trends and Innovations

1. Eco-Friendly Chemical Formulations

Green chemistry is gaining momentum. Biodegradable and non-toxic formulations are being introduced, particularly for offshore operations, where environmental impact is a key concern.

2. Nanotechnology in Oil Field Chemicals

Nanoparticles are being used to improve the effectiveness of scale inhibitors and corrosion preventatives, providing more targeted and longer-lasting solutions.

3. Hybrid Chemical Systems

Manufacturers are developing multifunctional chemicals that can perform multiple tasks—such as acting as both a corrosion and scale inhibitor—reducing the number of chemicals needed on-site.

4. Strategic Alliances and Mergers

Companies are increasingly collaborating to pool R&D capabilities, share regulatory burdens, and expand market reach. Joint ventures between chemical manufacturers and oil field service companies are becoming common.

Competitive Landscape

The Europe oil field specialty chemicals market is moderately consolidated, with global and regional players competing through innovation, customization, and service quality. Key companies include:

-

BASF SE (Germany) – Strong presence in production chemicals with sustainability-focused innovations.

-

Schlumberger Limited – Offers integrated chemical management services across the value chain.

-

Baker Hughes – Known for advanced stimulation and production chemical technologies.

-

Halliburton – Provides a wide range of specialty chemicals through its Baroid product line.

-

Clariant AG – Focuses on offshore and environmentally friendly solutions.

-

Croda International Plc – Gaining ground with green surfactants and specialty additives.

Many of these companies are investing in European manufacturing bases or local R&D centers to better serve clients and respond to region-specific regulatory needs.

Future Outlook

The European oil field specialty chemicals market is expected to maintain a steady growth path through the end of the decade, shaped by the following trends:

-

Increased investment in mature field redevelopment

-

Growth in chemical EOR demand

-

More stringent environmental compliance requiring innovative solutions

-

Greater digital integration in chemical delivery and monitoring systems

The transition to greener formulations and smarter chemical management will be vital for competitiveness and compliance in the coming years. Additionally, niche markets—such as geothermal drilling and carbon capture & storage (CCS) operations—may open new avenues for specialty chemical applications.

Conclusion

The Europe oil field specialty chemicals market is poised for steady growth amid evolving operational and environmental needs. While challenges persist, particularly around regulation and energy transition, the market offers robust opportunities for innovation and strategic differentiation. Manufacturers that focus on sustainable, high-performance, and digitally integrated chemical solutions will be best positioned to thrive in the shifting energy landscape of Europe.

Get more Details

https://www.databridgemarketresearch.com/reports/europe-oil-field-specialty-chemicals-market