Market Overview

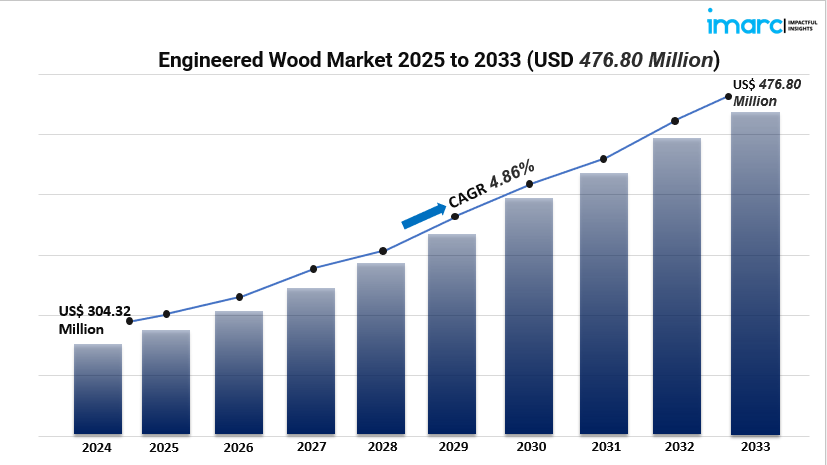

The global engineered wood market is experiencing robust growth, fueled by the increasing demand for sustainable, cost-effective, and aesthetically pleasing construction materials. In 2024, the market reached a volume of 304.32 million cubic meters and is projected to expand to 476.80 million cubic meters by 2033, reflecting a CAGR of 4.86% during 2025–2033. This growth is driven by the rising popularity of intricate flooring patterns, custom cabinetry, and visually striking structural designs, along with an increase in construction projects such as residential complexes, commercial buildings, and public infrastructure, and the growing need for affordable solutions.

Study Assumption Years

- Base Year: 2024

- Historical Years: 2019–2024

- Forecast Years: 2025–2033

Engineered Wood Market Key Takeaways

- Market Size and Growth: The global engineered wood market was valued at 304.32 million cubic meters in 2024 and is projected to reach 476.80 million cubic meters by 2033, growing at a CAGR of 4.86% during 2025–2033.

- Regional Dominance: Asia-Pacific leads the market with a 36.5% share in 2024, driven by rapid urbanization, government-backed infrastructure projects, and a growing preference for sustainable building materials.

- Product Segmentation: Plywood dominates the product segment, accounting for 43.5% of the market share in 2024, owing to its strength, stability, and versatility in various applications.

- Application Insights: The furniture segment leads the application category, benefiting from engineered wood’s cost-effectiveness, durability, and sustainability, making it ideal for high-quality furniture production.

- End-User Trends: The residential sector holds the largest share at 48.9% in 2024, as engineered wood’s versatility and efficiency make it a preferred choice for home construction and renovation projects.

Market Growth Factors

- Technological Advancements in Engineered Wood Production

The engineered wood industry is seeing big tech changes to make better products and work faster. Companies are buying automated systems and fancy machines like CNC (Computerized Numerical Control) to create custom panels with tricky shapes and exact measurements. These new tools don’t just save energy – they also make engineered wood stronger, which makes it more attractive for today’s building projects. All these improvements have an impact on how well engineered wood performs giving it an edge in modern construction.

- Regulatory Support and Environmental Considerations

Across the globe, governments are putting tough environmental rules in place and pushing for green building methods, which helps the use of engineered wood grow. The U.S. Department of Commerce says engineered wood cuts down on material waste by 30%, which fits with green building rules. This backing from regulators makes builders and developers more likely to pick engineered wood instead of old-school materials, which helps the market expand.

- Rising Demand in Construction and Furniture Sectors

The building and furniture sectors use engineered wood because it’s cheap long-lasting, and looks good. In construction, products like plywood and laminated veneer lumber (LVL) are strong and eco-friendly without breaking the bank making them a good fit for homes and businesses. Likewise, in the furniture world engineered wood helps companies make top-notch furniture for less meeting buyers’ needs for affordable and green options.

Request for a sample copy of this report: https://www.imarcgroup.com/engineered-wood-market/requestsample

Market Segmentation

By Type

- I-Beams: Engineered wood I-beams are structural components designed for strength and stability, commonly used in floor and roof framing applications.

- Plywood: Plywood, comprising thin layers of wood veneer glued together, offers exceptional strength and versatility, making it suitable for furniture, cabinetry, flooring, and construction.

- Laminated Veneer Lumber (LVL): LVL is made by bonding thin wood veneers together, providing high strength and uniformity, ideal for beams, headers, and edge-forming materials.

- Glulam (Glued Laminated Timber): Glulam consists of layers of dimensional lumber bonded with durable adhesives, used in large-scale structural applications like bridges and buildings.

- Oriented Strand Boards (OSB): OSB is formed by compressing layers of wood strands with adhesives, offering strength and cost-effectiveness for sheathing and flooring.

- Cross-Laminated Timber (CLT): CLT is made by stacking layers of lumber perpendicular to each other and bonding them, providing high structural rigidity for walls, floors, and roofs.

- Others: This category includes various other engineered wood products designed for specific structural and aesthetic applications.

By Application

- Construction: Engineered wood is extensively used in construction for framing, flooring, and structural components due to its strength, durability, and cost-effectiveness.

- Furniture: In furniture manufacturing, engineered wood offers versatility and sustainability, allowing for the production of high-quality, affordable furniture pieces.

- Flooring: Engineered wood flooring combines the aesthetic appeal of hardwood with enhanced stability, making it suitable for various residential and commercial settings.

- Packaging: Engineered wood is utilized in packaging for its strength and lightweight properties, ensuring the safe transport of goods.

- Others: This segment includes miscellaneous applications of engineered wood across different industries.

By End User

- Residential: Engineered wood is widely adopted in residential construction for its versatility, consistency, and efficiency, catering to various construction needs.

- Commercial and Industrial: In commercial and industrial sectors, engineered wood is used for its structural integrity and adaptability in various applications.

Breakup by Region

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

Regional Insights

The Asia-Pacific region leads the engineered wood market claiming 36.5% of the global share in 2024. This leadership stems from quick urban growth, government-supported infrastructure projects, and increasing demand for eco-friendly building materials. China and India are putting a lot of money into affordable housing and smart city plans, which boosts the need for engineered wood products in the area even more.

Recent Developments & News

The engineered wood industry has witnessed several significant developments:

- July 2024: JP Wood Accents expanded into the flooring market, introducing wide plank engineered wood flooring to cater to both commercial and residential clients.

- March 2024: LP Building Solutions launched LP® SmartSide® Pebbled Stucco Panel Siding, an engineered wood product designed for durability and versatility in various climates.

- December 2023: Weyerhaeuser announced a USD 96.2 million investment to modernize and decarbonize its lumber mill in Louisiana, aiming to reduce greenhouse gas emissions and improve productivity.

- October 2023: Boise Cascade completed the acquisition of Brockway-Smith Company (BROSCO®), enhancing its product offerings in the building materials sector.

- September 2023: West Fraser Timber Co. Ltd. agreed to acquire Spray Lake Sawmills, expanding its presence in Southern Alberta and strengthening its Canadian treated wood business.

Key Players

- Boise Cascade Company

- Havwoods Ltd

- Huber Engineered Woods LLC (J.M. Huber Corporation)

- Louisiana-Pacific Corporation

- Mayr-Melnhof Holz Holding AG

- Nordic Structures

- Pacific Woodtech Corporation (Daiken Corporation)

- Roseburg Forest Products Co.

- Stora Enso Oyj

- UFP Industries Inc.

- West Fraser Timber Co. Ltd

- Weyerhaeuser Company

Ask Analyst for Customization: https://www.imarcgroup.com/request?type=report&id=5404&flag=C

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include a thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape, and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No: +1-631-791-1145