When it comes to managing your company’s finances, choosing the right tools can make all the difference. If you’re looking for a reliable and effective way to handle your business payments, you might want to consider Intuit business checks. Now, you might be wondering why these checks are so special. Let’s dive into why these checks might just be the best choice for your company.

1. Ease of Use

One of the biggest perks of Intuit business checks is how easy they are to use. Designed with the user in mind, these checks integrate seamlessly with Intuit’s QuickBooks software. If you already use QuickBooks for accounting, adding Intuit checks to your routine is a breeze. The integration means that you can print checks directly from your accounting software, saving time and reducing the chance of errors.

Imagine having to manually enter data each time you write a check. Not only is this time-consuming, but it also increases the risk of mistakes. With Intuit checks, the information you need is pulled directly from your QuickBooks data. This ensures accuracy and speeds up the process, allowing you to focus on other important tasks.

2. Professional Appearance

First impressions matter, and this is especially true in business. When you send a check to a vendor, client, or partner, you want it to look professional. Intuit checks help you achieve this with their sleek design and customizable features. You can add your company logo, choose from a variety of fonts, and select colors that match your brand.

Having a professional-looking check can enhance your company’s image. It shows that you pay attention to detail and care about presenting a polished front. This can be especially important when dealing with new clients or high-profile partners. A well-designed check can leave a lasting positive impression.

3. Security Features

In today’s world, security is a major concern. This is especially true in terms of financial transactions. Intuit business checks come with several security features designed to protect your company from fraud. These include watermarks, micro-printing, and heat-sensitive ink.

Watermarks are difficult to replicate and make it easy to identify genuine checks. Micro-printing involves printing very small text that is hard to reproduce accurately. Heat-sensitive ink changes color when exposed to heat, making it easy to spot tampering. These features work together to provide a high level of security, giving you peace of mind when issuing checks.

4. Cost-Effective

Running a business involves managing costs carefully. Intuit checks offer a cost-effective solution for your company’s check-writing needs. Because they integrate with QuickBooks, you save on the time and resources that would otherwise be spent on manual data entry and reconciliation.

Additionally, you can get discounts for bulk orders from check providers, which can lead to significant savings. Investing in these checks is an investment in efficiency, security, and professionalism. Over time, the savings in time and reduced risk of errors can more than offset the initial cost.

5. Versatility

Intuit business checks are versatile and can be used for various types of payments. Whether you need to pay vendors, issue payroll checks, or handle other business expenses, these checks are up to the task. Their compatibility with QuickBooks means you can handle all your check-writing needs in one place, streamlining your financial processes.

Moreover, the ability to customize the checks means you can adapt them to different purposes. For example, you can design separate checks for payroll and vendor payments, making it easy to distinguish between different types of transactions. This level of versatility makes these checks a valuable tool for any company.

6. Customer Support

When you choose Intuit business checks from a reliable provider, you also gain access to excellent customer support. If you encounter any issues or have questions about your checks, you can reach out to their support team for assistance. This level of support can be a lifesaver, especially when you’re dealing with financial matters.

The customer support teams of check providers can be helpful. They can guide you through any issues you might encounter, ensuring that your check-writing process remains smooth and efficient. Knowing that help is just a phone call or email away can provide an added layer of confidence and security.

7. Easy Reordering

As your company grows, your check needs might increase. Intuit business checks are easy to reorder when you run low. The reordering process is straightforward, ensuring you never run out of checks at a critical moment. You can even set up automatic reordering to simplify the process further.

By streamlining the reordering process, your check provider can help ensure that your business operations remain uninterrupted. This convenience allows you to focus on other aspects of your business without worrying about running out of checks.

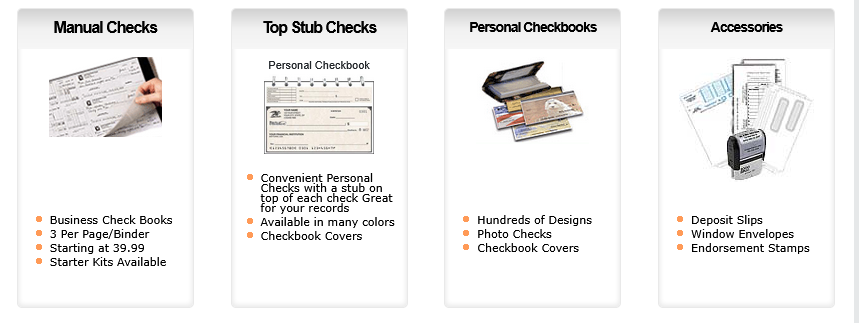

8. Customizable Check Layouts

Every business has unique financial needs. Intuit business checks offer customizable layouts to suit your specific requirements. Whether you need checks with stubs for record-keeping or three-to-a-page checks for easier handling, there are options to fit your needs.

Customization goes beyond just appearance; it extends to functionality. You can choose the layout that best fits your accounting processes, ensuring that your check system works seamlessly with your business operations.

9. Integration with Other Intuit Products

If you use other Intuit products, you’ll appreciate how well Intuit business checks integrate with the entire ecosystem. This integration allows for a more cohesive financial management system where all your tools work together harmoniously.

Using a suite of products can streamline your operations and reduce the learning curve for new tools. Intuit’s ecosystem is designed to make financial management as easy and efficient as possible, and its business checks are a key part of that system.

Conclusion

Intuit business checks are a top choice for businesses for many reasons. Their ease of use, professional appearance, security features, cost-effectiveness, versatility, and excellent customer support make them an invaluable tool. Additionally, their easy reordering process, customizable layouts, and integration with other Intuit products further enhance their appeal. By choosing these checks, your company can enjoy a smoother, more efficient check-writing process.