Crypto signal trading has become an essential instrument for traders seeking to optimize their earnings in the rapidly evolving cryptocurrency market. However, what are these signals exactly? In essence, they are recommendations or signals that tell traders when to purchase, sell, or keep onto cryptocurrencies. Given the volatility of the market, having trustworthy indications might be the difference between profiting and losing money.

What Are Crypto Signals?

Crypto signals are recommendations based on various analyses that inform traders about potential trading opportunities. These signals can be generated by experienced traders or automated systems and typically include key information such as the cryptocurrency to trade, entry and exit points, and stop-loss levels.

Importance of Crypto Signal Trading in Today’s Market

As more people venture into cryptocurrency trading, understanding how to leverage crypto signal trading becomes crucial. These signals help traders navigate market complexities, making informed decisions without needing to constantly monitor price movements. This is particularly beneficial for those who may not have time to dedicate to full-time trading.

Types of Crypto Signals

Buy Signals

A buy signal indicates that it’s a good time to purchase a specific cryptocurrency, based on market analysis suggesting that its price will rise. This could be due to various factors, including market trends or technical indicators.

Sell Signals

Conversely, a sell signal suggests that it’s time to liquidate your position in anticipation of a price drop. Recognizing these signals can help traders minimize losses and maximize profits.

Hold Signals

A hold signal advises traders to maintain their current positions rather than buying or selling. This can indicate that the market is stable or that there isn’t a clear opportunity at the moment.

Automated vs. Manual Signals

Signals can be generated manually by experienced traders or automatically through algorithms and trading bots. While manual signals may offer personalized insights, automated signals can provide faster responses based on real-time data.

How to Interpret Crypto Signals

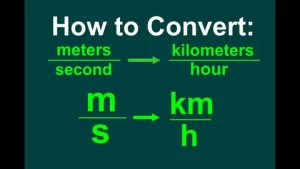

Technical Analysis Basics

Understanding technical analysis is essential for interpreting crypto signals effectively. This involves studying price charts and using indicators like moving averages and RSI (Relative Strength Index) to predict future price movements.

Fundamental Analysis in Crypto Trading

Fundamental analysis looks at external factors influencing cryptocurrency prices, such as regulatory news or market sentiment. Combining both technical and fundamental analyses can provide a more comprehensive view for traders.

Common Indicators Used in Signal Trading

Several indicators are commonly used in crypto signal trading, including:

- Moving Averages: Help identify trends over specific periods.

- MACD (Moving Average Convergence Divergence): Indicates momentum changes.

- Bollinger Bands: Show volatility and potential price movements.

The Role of Signal Providers

Choosing a Reliable Signal Provider

Selecting the right signal provider is crucial for successful trading. Look for providers with a proven track record and transparent methodologies behind their signals.

Free vs. Premium Signals

While many platforms offer free crypto signals, premium services often provide more accurate and timely information. Weighing the cost against potential returns is essential when deciding which service to use.

Strategies for Successful Crypto Signal Trading

Risk Management Techniques

Implementing risk management strategies is vital in trading. This includes setting stop-loss orders and only investing what you can afford to lose.

Timing Your Trades

The cryptocurrency market operates 24/7, making timing crucial. Quick reactions to buy or sell signals can significantly impact profitability.

Combining Signals with Other Tools

Using crypto signals alongside other tools—like charting software or news aggregators—can enhance decision-making processes.

Common Mistakes to Avoid in Signal Trading

Overreliance on Signals

While crypto signals are helpful, relying solely on them without conducting personal analysis can lead to poor decisions.

Ignoring Market Trends

Staying informed about broader market trends is essential; ignoring these can result in missed opportunities or losses.

FOMO and Emotional Trading

Fear of missing out (FOMO) can lead traders to make impulsive decisions based on emotions rather than sound analysis.

Conclusion

In conclusion, crypto signal trading offers valuable insights for navigating the complex world of cryptocurrency. By understanding different types of signals, employing effective strategies, and avoiding common pitfalls, traders can enhance their chances of success in this volatile market. As technology advances, so will the tools available for traders, making it an exciting time to engage with crypto markets.

FAQs

What is the best platform for crypto signal trading?

The best platform varies by individual needs; however, platforms like Telegram groups or dedicated trading apps are popular choices among traders.

Can beginners use crypto signals effectively?

Yes! Beginners can benefit from using crypto signals as they provide guidance; however, it’s important they also learn basic trading principles.

How often should I check my signals?

Regularly checking your signals—ideally multiple times daily—can help you stay updated on market changes and opportunities.

Are crypto signals guaranteed to be profitable?

No, while they provide insights based on analysis, there are no guarantees in trading due to market volatility.

What should I do if a signal doesn’t perform as expected?

If a signal fails, assess your strategy and consider adjusting your approach; learning from each trade is key to improving your skills over time.

Checkout TheGuestBlogs for more insightful blogs!